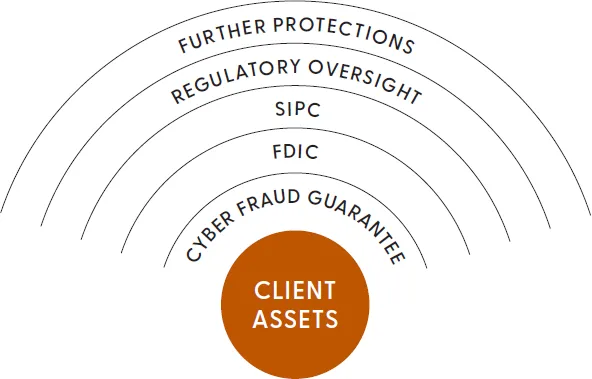

Multiple layers of protection

We offer you a layered approach to protecting your assets, which is, and will continue to be, a top priority for LPL.

Cyber fraud guarantee

As cyber threats continue to evolve and make headlines, you can rely on LPL's security teams' capabilities to defend against potential cyber incidents to minimize the potential impact to LPL accounts. Our Information Security, Privacy, and Fraud organizations work together to make LPL a firm you can trust.

We're so confident in our measures that if you incur losses in your LPL accounts as a result of unauthorized access to an LPL system, we'll reimburse you 100% for those losses.

FDIC insured cash sweep solutions

While we are not a bank, LPL utilizes cash sweep programs that offer FDIC insurance through FDICinsured financial institutions. LPL offers two bank deposit sweep programs, the LPL Insured Cash Account (ICA) and LPL Deposit Cash Account (DCA). Cash balances in the ICA and DCA are deposits and are eligible for FDIC insurance up to $250,000 for individuals and $500,000 for joint accounts per bank. For additional protection, LPL's multi-bank cash sweep programs are designed to reduce risk to investors' cash by depositing cash in multiple banks. This approach provides up to ten times the FDIC insurance coverage on cash in the ICA and DCA, making individual account holders eligible for up to $2.5 million or, in the case of joint accounts holders, $5 million, in FDIC insurance.

SIPC membership & Excess of SIPC protection

Our Securities Investor Protection Corporation (SIPC) membership provides account protection up to a maximum of $500,000 per customer, of which $250,000 may be claims for cash. For an explanatory brochure, please visit www.sipc.org. In addition to SIPC protection, LPL purchases Excess of SIPC protection through Lloyd's of London with an aggregate limit of $1 billion.* Our coverage ratio is industry-leading and reflects a strong commitment to protecting client assets.

Regulatory oversight

We're committed to ensuring your financial professional provides you with guidance that aligns with your needs and objectives. This includes adhering to all relevant industry regulations and rules. We are regulated by federal, state, and selfregulatory agencies, including Financial Industry Regulatory Authority (FINRA), Securities Exchange Commission (SEC), Securities Investor Protection Corporation (SIPC), and Municipal Securities Rulemaking Board (MSRB).

Further protections

- LPL must identify and segregate securities and funds for each client, so that if the firm fails financially, these securities and funds would be readily available to be returned to clients.

- LPL is required to maintain minimum net capital and to set aside a reserve for the benefit of its clients. In addition, LPL's financial statements are audited annually by an independent public accountant, and those financial statements are filed regularly with the SEC.

- LPL is required to purchase a fidelity bond from an insurance company to provide a source of compensation to customers in the event of fraud or embezzlement by employees.

- LPL also purchases additional amounts of professional liability insurance.

Please let your financial professional know if you would like further information.

* Subject to conditions and limitations. The account protection applies when an SIPC member firm fails financially and is unable to meet obligations to securities clients, but it does not protect against losses from the rise and fall in the market value of investments.